One app. Your

.avif)

It’s a gateway for traders to efficiently capitalize on macro news across traditional financial markets, all with the speed and accessibility of decentralized finance’’

Insights

Frequently Asked Questions

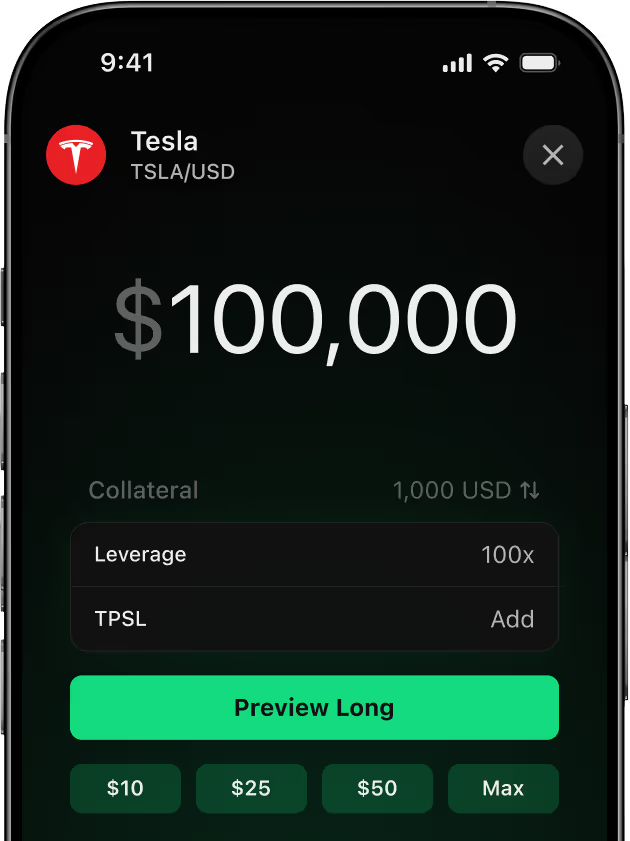

Ostium is a self-custodial leveraged trading platform built on crypto rails. You can trade stocks, currencies, indices, commodities, and cryptocurrencies directly on Arbitrum, an Ethereum Layer 2 blockchain.

Ostium offers assets unique among crypto platforms, with transparency unmatched by traditional brokers.

- Self-custody: You control your funds at all times.

- Leverage: Trade with up to 200x leverage.

- Assets: Stocks, FX, commodities, global indices, and crypto perpetuals.

- Transparency: All fees, volumes, and liquidity are public on-chain.

Unlike traditional CFD or FX brokers, Ostium cannot freeze your funds, restrict trading, or manipulate spreads.

Ostium offers trading without the restrictions and opacity of centralized brokers.

Key Advantages

- Instant deposits with no limits.

- No middleman custody: funds remain in your wallet.

- Transparent trading environment: spreads, fees, and volumes are public on-chain.

- Wide market access: trade stocks, FX, indices, commodities, and crypto all in one place.

- High leverage: trade with up to 200x across assets.

For traditional traders, this means familiar products with greater freedom and security.

Perpetual contracts (“perps”) are already the dominant product in crypto. Ostium extends them to traditional assets as well.

- Trade all markets in one place: SPX, gold, oil, TSLA. Ostium lists commodities, stocks, indices, FX, and crypto.

- Discover new markets: Ostium's proprietary price quoting system, powered by exchange-licensed data, enables new listings quickly.

- Stay fully on-chain: no need to sign up with a centralized broker to access TradFi assets.

You only need a wallet (or an email address) and a funding method.

- No wallet yet? Ostium's third-party providers generate a secure wallet using MPC (Multi-Party Computation) technology. You can fund it with USDC via:

- Credit card

- Bank transfer

- Centralized exchanges (Binance, Coinbase, Kraken)

- Another crypto wallet

- Already have a wallet? Just connect MetaMask, Rabby, Coinbase Wallet, or any other EVM-compatible wallet.

Ostium also supports one-click trading (1CT), session keys, and gas sponsorship—so you don’t need to approve every transaction or worry about gas fees.

Yes. Ostium is self-custodial.

- Funds remain yours: Ostium cannot access or freeze wallet funds.

- Trades stay open: Ostium cannot arbitrarily close your positions.

- No account lockouts: unlike centralized exchanges, Ostium cannot close your account.

No. Ostium provides synthetic exposure through perpetual contracts.

- Example: trading BTC perps gives you exposure to BTC’s price, but not the underlying asset.

- TradFi assets too: Ostium’s gold or S&P contracts provide leveraged price exposure without delivering the physical asset.

This structure makes it possible to trade the price movements of assets like oil, copper, or equities fully on-chain—without tokenization or custody.

Ostium uses USDC (a stablecoin pegged to the U.S. dollar) on Arbitrum for trading and settlement.

You can fund your account in several ways:

- Purchase USDC with a card or via SEPA in the EU.

- Transfer from centralized exchanges such as Binance, Coinbase, Kraken, and others.

- Receive from other crypto wallets, including those on other chains.

Ostium charges a small opening fee when you open a position.

- Traditional assets: a simple flat taker fee (e.g., 3–10 bps, depending on the asset) and a rollover fee.

- Crypto pairs: maker/taker model and a funding fee.

View the full fee breakdown for more information.

.avif)